How to Invest for the Macro Environment (Permanent Portfolio in 2024)

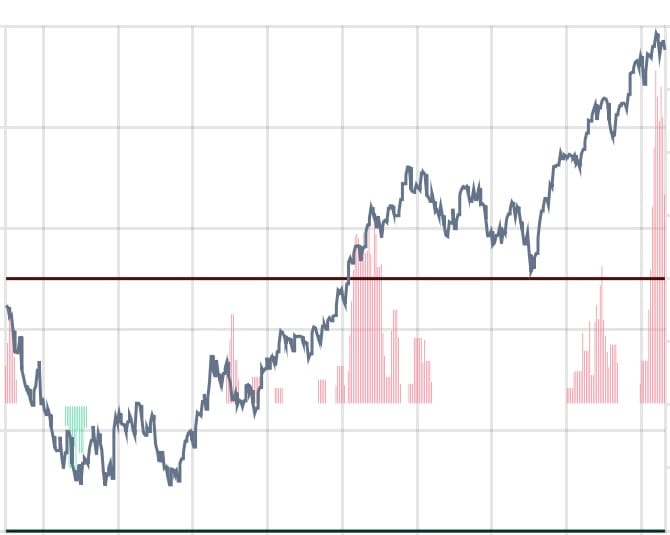

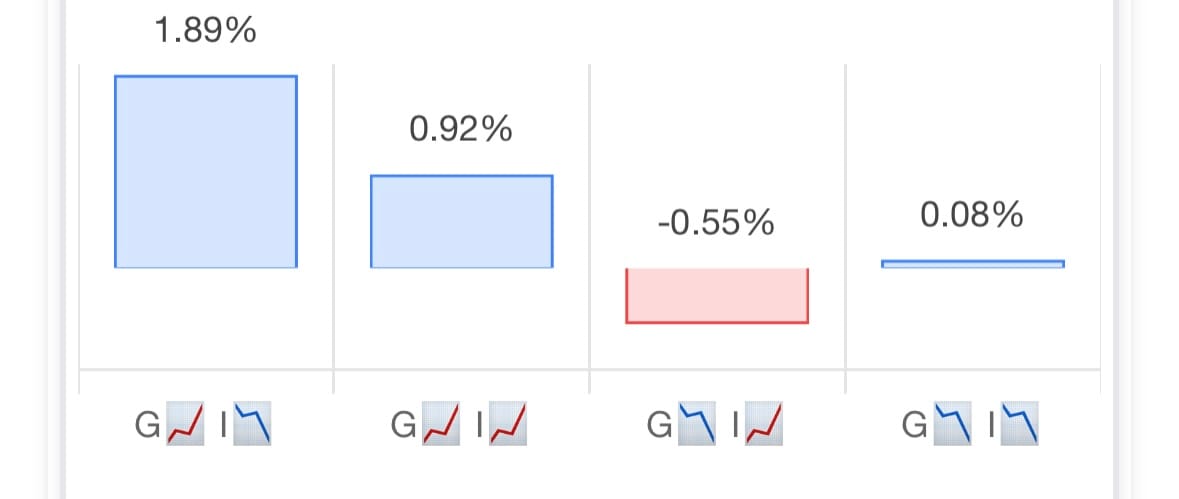

The popular wisdom is stocks for the long run. That has worked phenomenally well over the last 100+ years for US investors (we are sitting at all-time highs as I write this!), But tucked into those decades of compounding are occasional periods of significant underperformance. But as the saying goes, there's always a bull market somewhere. Different asset classes and even different stocks can and often do perform well when the broader market is weak. That's the essence of diversification and any

The Macro Sherpa evolved over years on the desk as an analyst at multiple billion dollar asset managers. Quantitative models, tools, and analysis were de rigueur.