- Published on

Correction Incoming for US Equities!? (New Bubble Model Signals)

Pardon the clickbait title, anon. But alas, our LPPLS bubble model did recently trigger new “Correction Likely“ signals for the Nasdaq-100 (QQQ) and the S&P 500 (SPY).

Quick primer… The Log Periodic Power Law Singularity (LPPLS) model is a mathematical model that is fit to an asset’s price history. It is designed to predict the emergence of financial bubbles. The model defines a bubble as a faster-than-exponential move up in price.

The Bubble Early Warning Indicator is an output from this model that measures the percentage of days over a preceding period (we use a 120 day lookback) that exhibited hyperexponential moves up. Different thresholds for what actually triggers a warning have been investigated, 5 and 10% being common in research (find links to relevant papers under the LPPLS tab). We've opted for the 10% threshold – happy to give up a little trigger speed in exchange for a potentially higher hit rate.

After their recent surges to all-time highs, the spoos and q’s have both triggered correction likely signals. While obviously correlated, we also throw in Nvidia (NVDA) as a bonus.

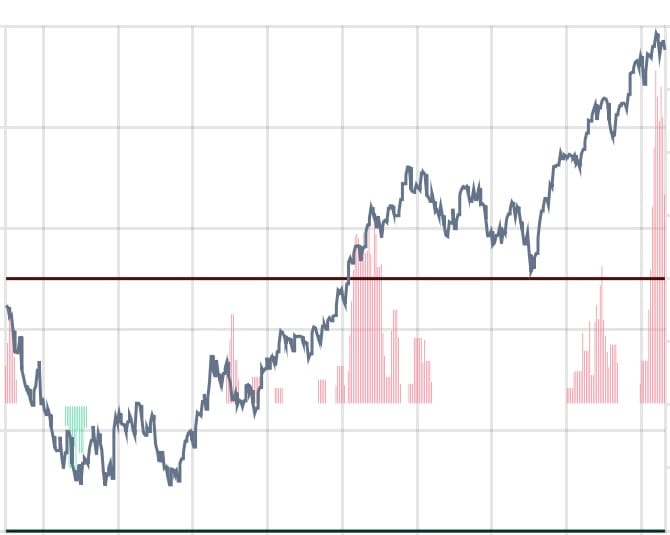

NASDAQ-100 (QQQ)

The tech high flyers are looking a little top heavy, with an early bubble warning metric of 25%, more than double the Maginot Line we set at 10%. While it took a couple of weeks to resolve, you can see that the roughly 10% correction we saw over the summer was preceded by a clustering of signals breaching that 10% threshold.

These models aren't perfect in terms of timing, but they can significantly improve your odds in betting whether the next 5, 10, 15% move will be higher or lower.

S&P 500 (SPY)

Also hovering near all-time highs, the bellwether US equity index is approaching 20% on the early warning indicator index. Not quite as overheated as the Nasdaq, but still well past the 10% early warning threshold. Much cleaner signal before the summer correction too, with the early warning indicator surging past 30% right around that local peak near the $450 level.

Nvidia (NVDA)

NVDA is on of the largest holdings in both QQQ and SPY, so it should come as no surprise that it's also crossed the chasm into "correction likely" territory.

Including it here as a bonus because of its absolutely vertical price action of late, but also because it shows some nuance compared to the others in terms of how these model signals can resolve. Two main notes:

- The first cluster of signals in Winter 2023 did not result in a correction. NVDA actually melted up faster into the second cluster of signals in early summer.

- While that signal did not resolve into a clear correction, it did mark a period of exhaustion and consolidating price action.

Now here‘s the thing, I'm sure you've heard it before. All models are wrong! But some are useful.

Whether a correction even unfolds, how deep it could be, obviously we have no idea. But these models don’t trigger often so minimally it may be worth reevaluating risk at these levels.

As you can see, these signals accumulate and cluster, almost signaling a buildup of pressure. We'll be monitoring how this pressure resolves so don't touch that dial.

Check out the LPPLS tab here to learn more about the models.

Let’s see how it plays out.

🤙🏼,

macro sherpa

(not financial advice, obviously)