How Should Tech Founders Invest?

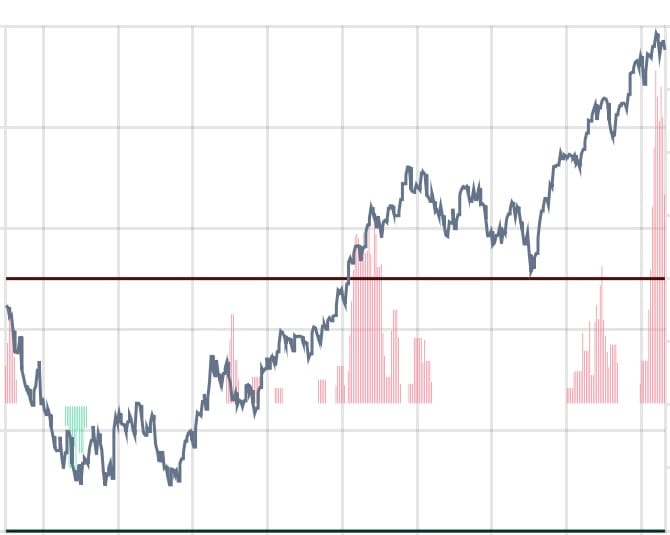

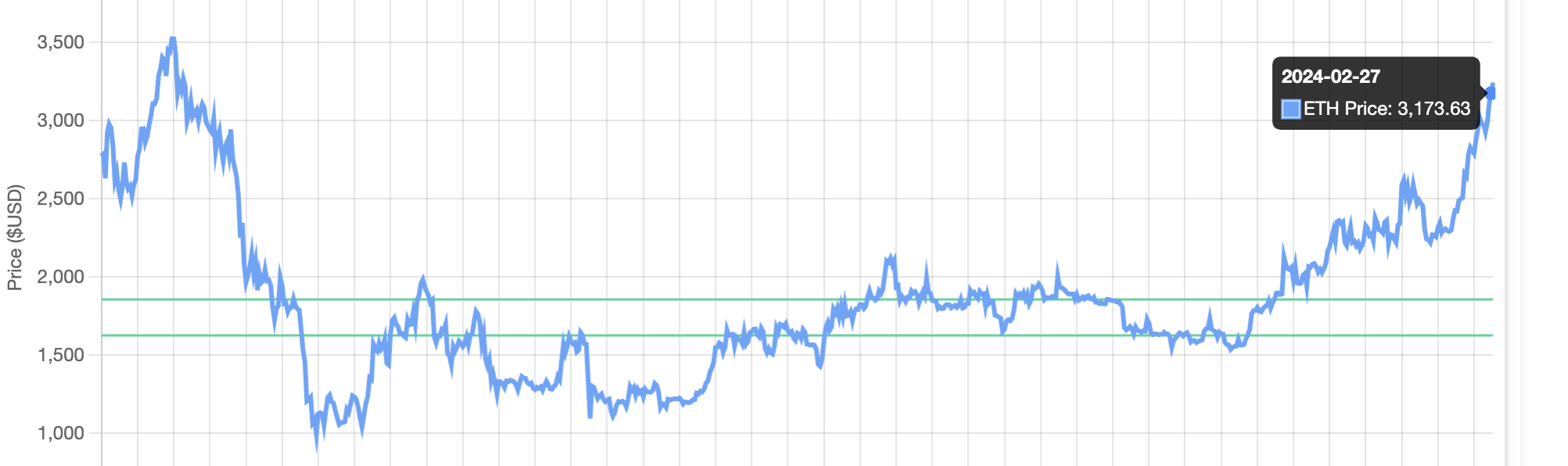

Quick hitter today. With all time highs in equity markets and fever dream rallies from Nvidia to Ethereum, it feels like the perfect time to reflect on how tech entrepreneurs should approach managing their wealth. The trope "invest in what you know" springs to mind immediately. But is that the best approach? It all depends on what you're optimizing for. If you're a tech founder, and all your investments outside your company are also tech or tech-adjacent (public or private markets), you're maki

The Macro Sherpa evolved over years on the desk as an analyst at multiple billion dollar asset managers. Quantitative models, tools, and analysis were de rigueur.