- Published on

How Should Tech Founders Invest?

Quick hitter today.

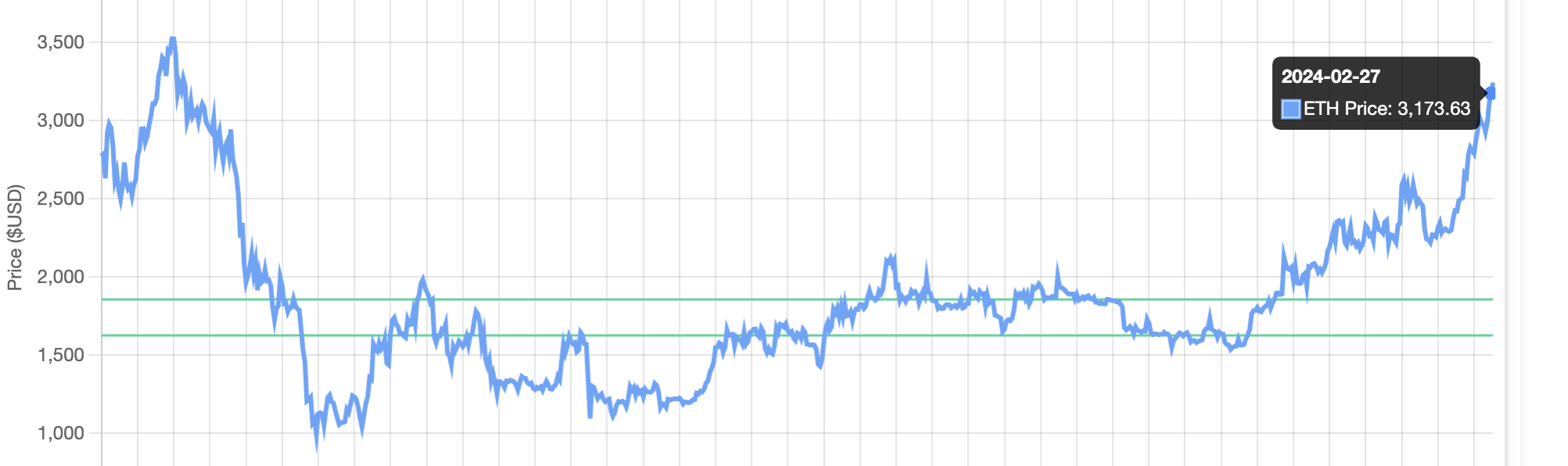

With all time highs in equity markets and fever dream rallies from Nvidia to Ethereum, it feels like the perfect time to reflect on how tech entrepreneurs should approach managing their wealth. The trope "invest in what you know" springs to mind immediately. But is that the best approach? It all depends on what you're optimizing for. If you're a tech founder, and all your investments outside your company are also tech or tech-adjacent (public or private markets), you're making correlated bets. You've essentially levered financial security to one industry. In a recession you could find your startup and savings wiped out.

One of the most classic and extreme cases of this is grandaddy of Frauds Enron. Enron famously allowed and encouraged their employees to purchase Enron stock in their 401k's. Those that did got zeroed.

This is where a more diversified approach like macroeconomic regime-based investing can come in. Popularized by Harry Browne's Permanent Portfolio and Ray Dalio's All-Weather Fund, the idea basic premise is to construct a portfolio of uncorrelated bets. Regardless of the economic environment, something in the portfolio is always working.

Founders should consider their startup equity in that correlation question. They can hedge some of their entrepreneurial risk by adopting an investment framework that is uncorrelated to their pursuits. Counterintuitively this can allow them to take more risk in their area of expertise, if their portfolio can zig when the tech industry and startup land can zag.

For the curious...

- Shout out to Mutiny Fund's Jason Buck for a particularly cogent discussion of this dynamic (podcast link).

- Check out our primer on regime-based investing

- Explore our free macro regime analysis tool to find the best performing assets across different economic environments

cheers,

macro sherpa