- Published on

Sherpa Trend Signal Updates 2024-02-24

Quiet week on the trend farm.

- Total signal flips: 1

- New longs: 3 (1 trad, 1 crypto)

- New shorts: 0

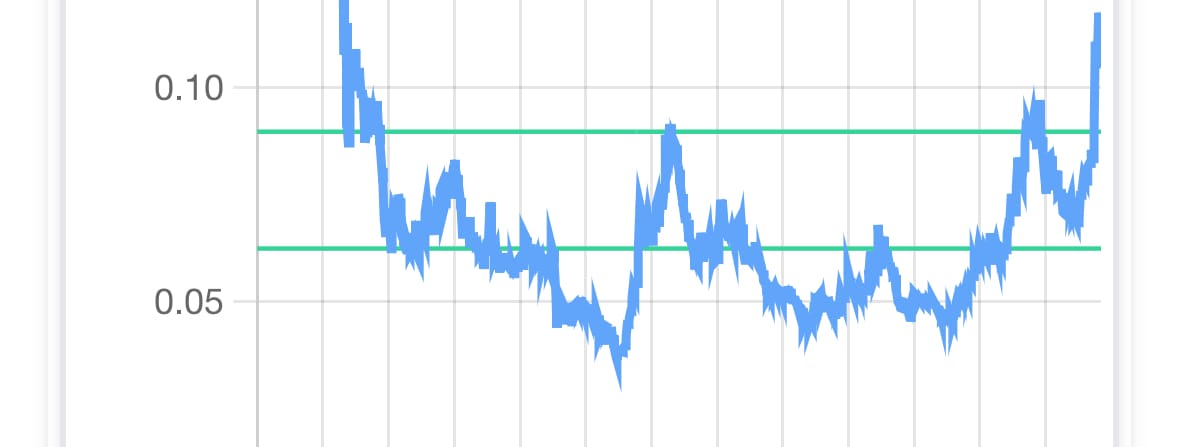

Some consolidation in crypto land over the last week or so after bitcoin's recent surge past $52,000. The result is another light week signal-wise. One alt coin ran the gauntlet of our 5-day persistence filter to achieve a valid signal on our long term (12 month) trend model – Hedera (HBAR).

| Asset | Fwd Return Horizon | Num Signals | Signal Hit Rate | Mean Fwd Return | Median Fwd Return | Fwd Return Std | Signal Direction |

|---|---|---|---|---|---|---|---|

| Hedera (hedera-hashgraph) | 1m Fwd Return | 3 | 100.0% | 13.7% | 10.2% | 14.5% | Long |

| Hedera (hedera-hashgraph) | 3m Fwd Return | 3 | 100.0% | 143.6% | 75.2% | 157.3% | Long |

| Hedera (hedera-hashgraph) | 12m Fwd Return | 2 | 100.0% | 1011.7% | 1011.7% | 33.1% | Long |

Quick glance at the chart shows this coin just broke out of a two year range. We are not swinging at this pitch. Hit rates and forward returns don't mean much with so little history.

Any dalliances in computer coin land outside of the majors for us lately have been playing the various layer 2 airdrop circuses. Generally prefer to be given alt-coins than buy them.

But the signal is there if you're feeling dangerous (NFA, obv!).

sherpa out 🤙🏼

Quick recap on the models:

- On the site we maintain daily time series momentum models with 3-month and 12-month lookback windows for hundreds of assets, ranging from s&p 500 constituents, sector, asset class, and country ETF's, to the top 100 cryptocurrencies by market cap. These signals come from this universe.

- The signals are calculated on a daily close basis, and for the purposes of this report, a new signal must persist for 5 days in order to be considered valid. The five days is arbitrary, but its a solid first-pass naive filter to help reduce chop and reduce market noise.